Fsa Limits 2025 Family Of 4

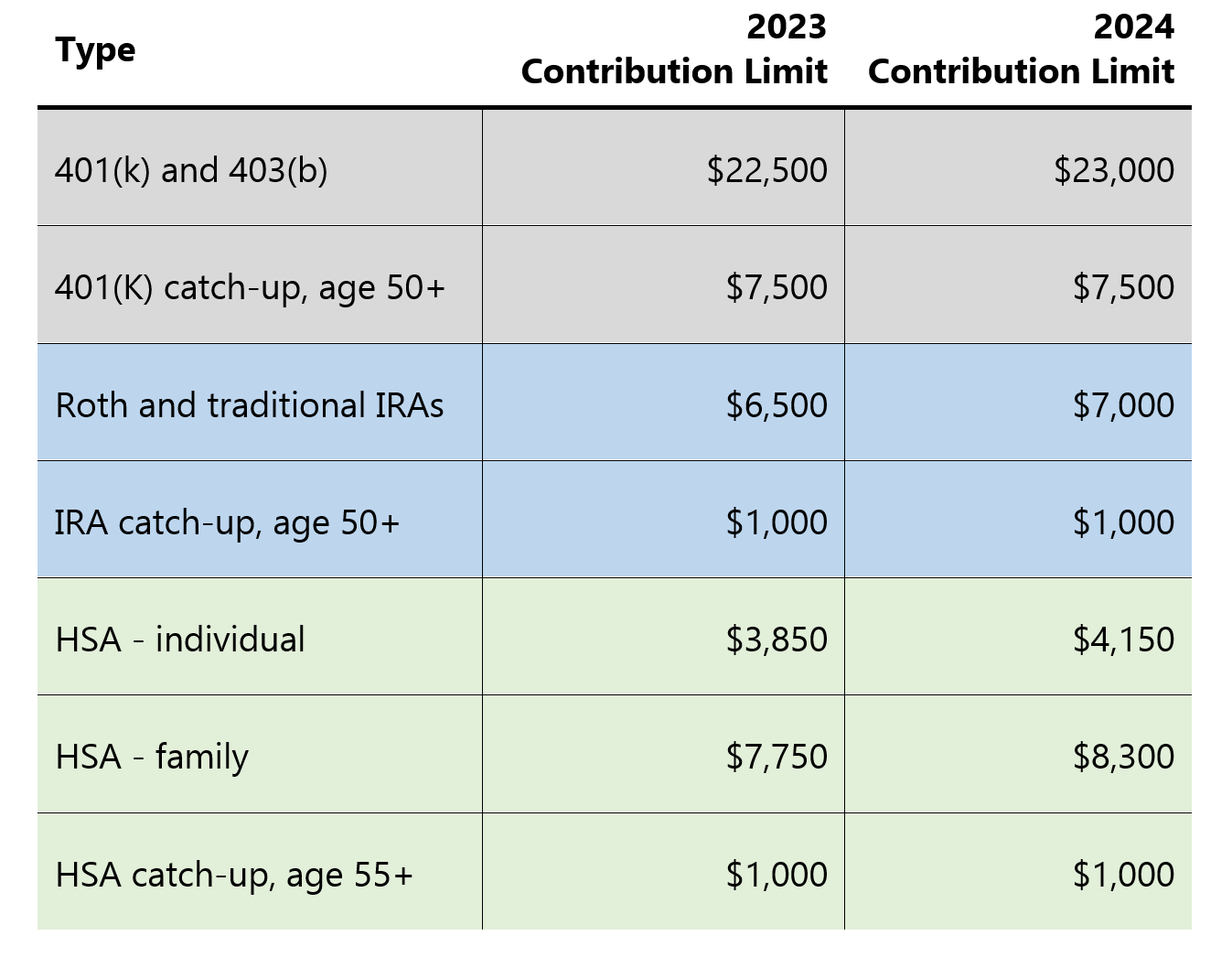

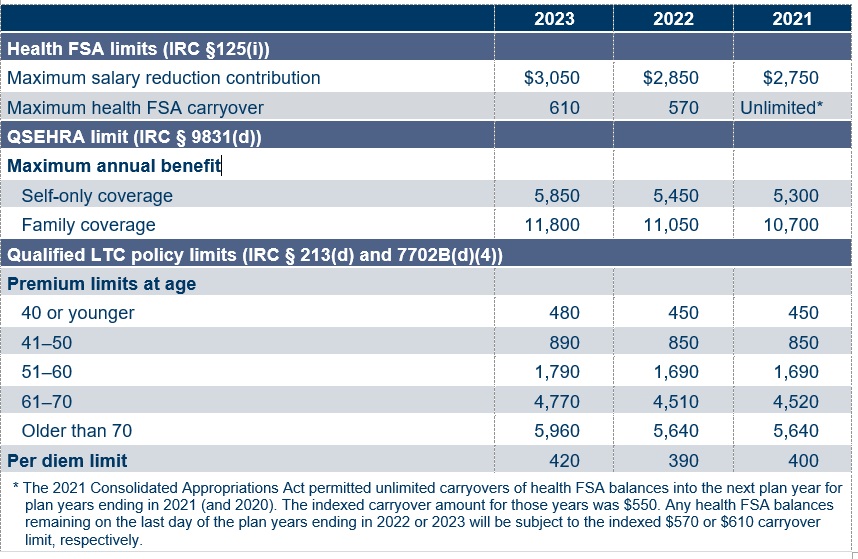

Fsa Limits 2025 Family Of 4. Annual maximum contribution levels are $4,150 for individuals and $8,300 for family coverage. The irs set a maximum fsa contribution limit for 2025 at $3,200 per qualified fsa ($150 more than the prior year).

For fsas that permit the carryover of. In 2025, workers can add an extra $150 to their fsas as the annual contribution limit rises to $3,200 (up from $3,050).

2025 Fsa Contribution Limits Family Of 4 Jody Magdalena, It’s open enrollment season for many organizations and knowing the updated fsa limits will help individuals better plan amounts to set aside.

2025 Fsa Contribution Limits Family Of 4 Jody Magdalena, The 2025 contribution limit is $3,200 (medical fsa).

Fsa Contribution Limits 2025 Family Danit Keeley, The irs has just announced updated 2025 fsa contribution limits, which are seeing modest increases over 2025 amounts.

Fsa Contribution Limits 2025 Family Lola Sibbie, The 2025 fsa contributions limit has been raised to $3,200 for employee contributions (compared to $3,050 in 2025).

Fsa Contribution Limits 2025 Family Member Karee Gertruda, Annual maximum contribution levels are $4,150 for individuals and $8,300 for family coverage.

2025 Hsa Contribution Limits And Fsa Accounts Grier Celinda, If the fsa plan allows unused fsa amounts to carry.

.png)

Fsa Family Limit 2025 Over 65 Tani Zsazsa, Individuals can contribute up to $4,150 in 2025, up $300 from 2025.

Fsa Limit 2025 Family Benefits Hope Ramona, The internal revenue service (irs) increased fsa contribution limits and rollover amounts for 2025.

S3Ep1 2025 FSA Limits M3 Insurance, Annual maximum contribution levels are $4,150 for individuals and $8,300 for family coverage.

2025 Hsa Contribution Limits And Fsa Funds Toni Agretha, The individual hsa contribution limit will be $4,150 (up from $3,850) and the family contribution limit will be $8,300 (up from $7,750).