Uk Corporation Tax Rates 2025

Uk Corporation Tax Rates 2025. From 1 april 2025 the corporation tax rate changes to: The united kingdom hm revenue and.

The measure sets the charge to corporation tax and sets the main rate at 19% for the financial year beginning 1 april 2025 and also sets the charge to ct for the. April 9, 2025, 5:00 am utc.

19% for taxable profits below £50,000 (small profit rate) 25% for taxable profits above £250,000 (main rate).

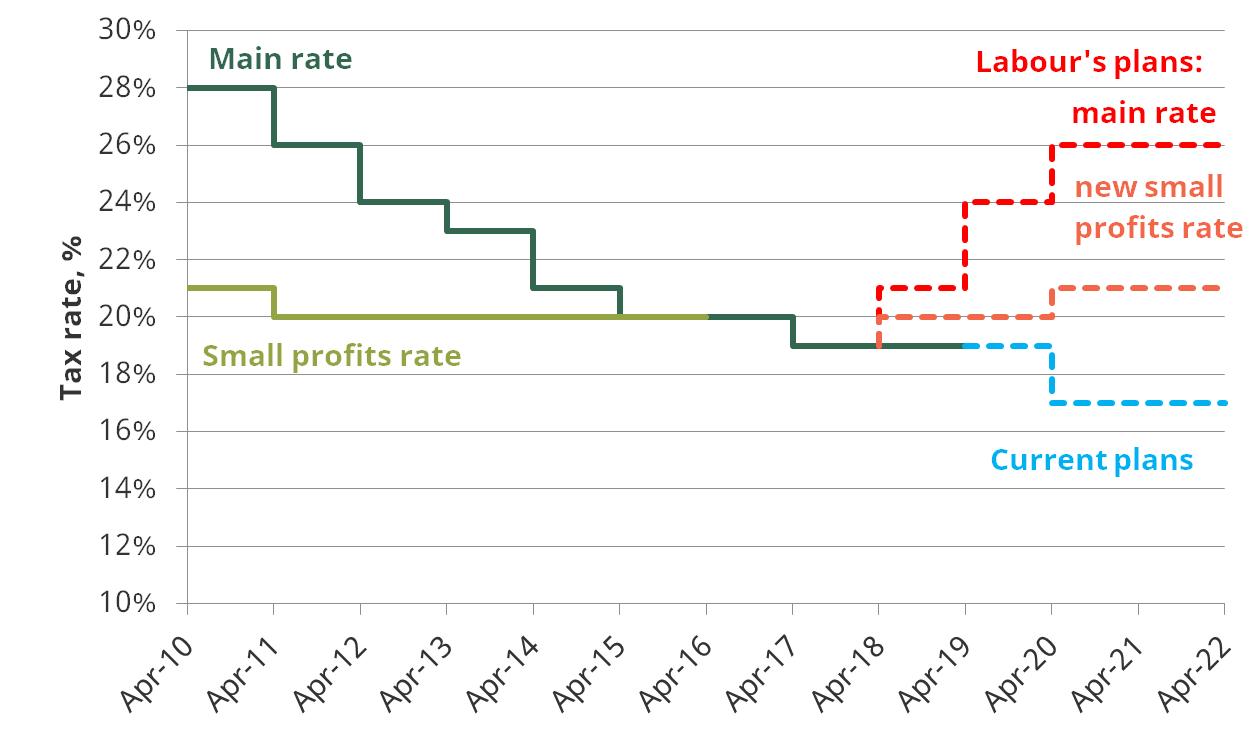

Tax rates for the 2025 year of assessment Just One Lap, For corporations, the 2025/2025 financial year marked the last year of corporation tax rates residing only at 19%.from april 2025, the. Following last year's political upheaval, the original plans to increase corporation tax rates in the uk will proceed from 1 april 2025, with a basic rate of 25 per.

Tax Rates Over Time Chart, The rate for the financial year starting 1 april 2025 for 275 days (1 april 2025 to 31 december 2025) next allowances and reliefs. From 1 april 2025, the main rate of corporation tax increased from 19% to 25%, and a new 19% small profits rate of corporation tax was introduced for companies whose profits do.

Infografik Unternehmensbesteuerung im Vergleich Statista, Marginal relief for corporation tax; Since 1st april 2025, the corporation tax rate for profits over £50,000 has risen to 25%.

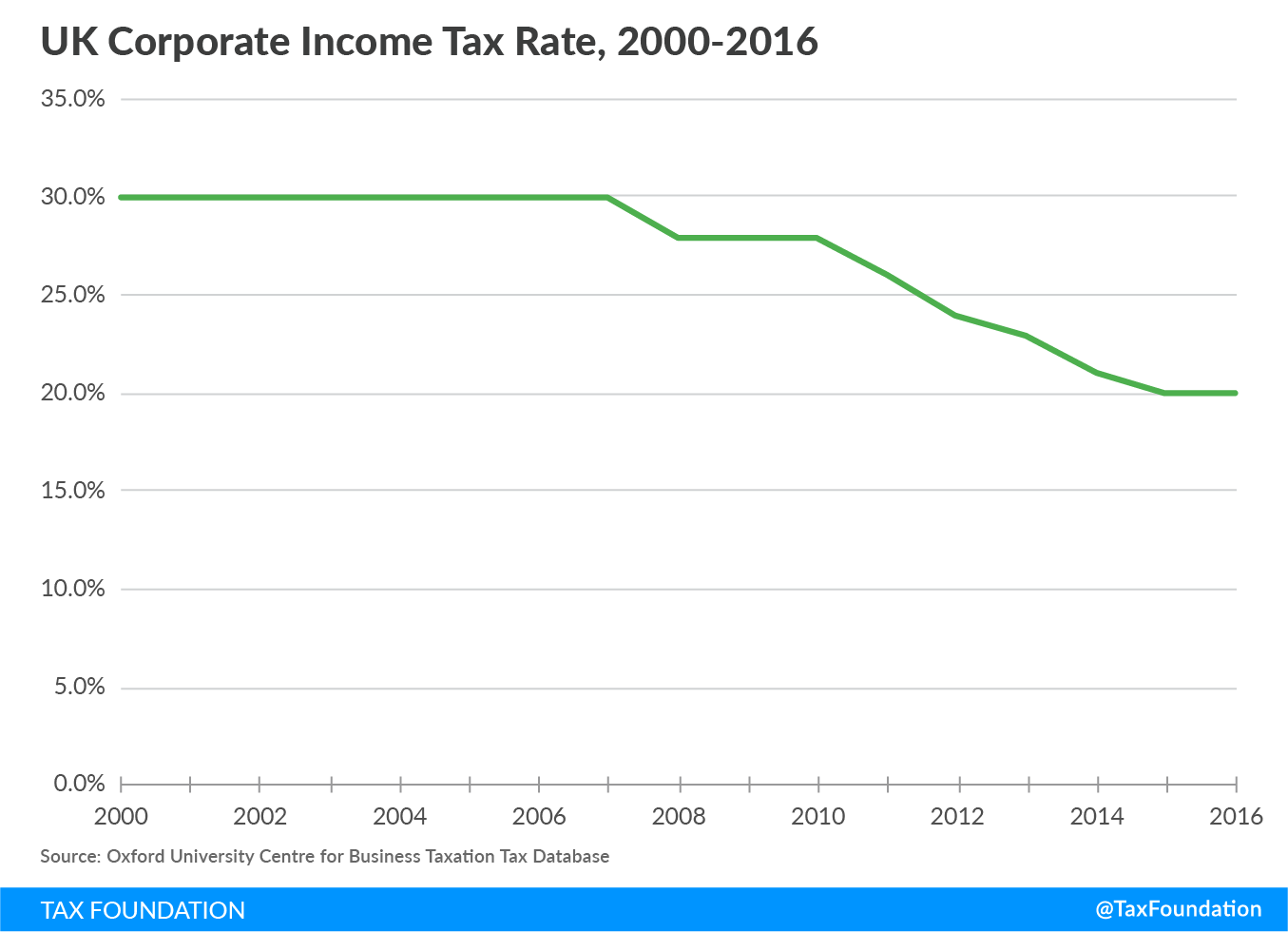

What We Can Learn from the UK’s Corporate Tax Cuts Tax Foundation, Following last year's political upheaval, the original plans to increase corporation tax rates in the uk will proceed from 1 april 2025, with a basic rate of 25 per. The corporation tax rate will increase to 25% from 1 april 2025, affecting companies with profits of £250,000 and over.

New UK Corporation Tax Rates From April 2025, Every limited company must file and pay corporation tax (or report that have nothing to pay if applicable). In order to ascertain whether a company is more beneficial for tax purposes, a comparison would have to be done between the rates of income tax/nic and corporation tax for small.

Labour’s reversal of corporate tax cuts would raise substantial sums, The main rate of corporation tax is 25% for the financial year beginning 1 april 2025 (previously 19% in the financial year beginning 1. The legislation that provided for this.

New UK corporation tax rates from April 2025 Article Cheltenham BPC, The new tax structure introduces a main rate of 25% for companies with. For corporations, the 2025/2025 financial year marked the last year of corporation tax rates residing only at 19%.from april 2025, the.

Corporation Tax Ambiance Accountants Sheffield Accountants, Changes to corporation tax from 1st april 2025. In order to ascertain whether a company is more beneficial for tax purposes, a comparison would have to be done between the rates of income tax/nic and corporation tax for small.

New UK corporation tax rates from April 2025, Following last year's political upheaval, the original plans to increase corporation tax rates in the uk will proceed from 1 april 2025, with a basic rate of 25 per. Added 19% corporation tax rate changes from 2017/18.

UK Corporation Tax Calculator 2025, The main rate of corporation tax is 25% for the financial year beginning 1 april 2025 (previously 19% in the financial year beginning 1. From 1 april 2025, the main rate of corporation tax increased from 19% to 25%, and a new 19% small profits rate of corporation tax was introduced for companies whose profits do.

The corporation tax rate will increase to 25% from 1 april 2025, affecting companies with profits of £250,000 and over.

The main rate of corporation tax is 25% for the financial year beginning 1 april 2025 (previously 19% in the financial year beginning 1.